A year of extremes

The first full pay round under pandemic conditions has been a year of extremes: from slump to boom in inflation and earnings growth; from millions on furlough to record vacancies; and from widespread pay freezes to labour shortages and 30+% pay rises. Those trends are continuing into the 2021-22 pay round.

To make sense of what has happened, and what it tells us about the months ahead, we’ve looked at the outcomes in over 900 pay settlements and rises implemented between August 2020 and July 2021. Normally, the centre ground in pay settlements would be a strong indicator of what’s been happening.

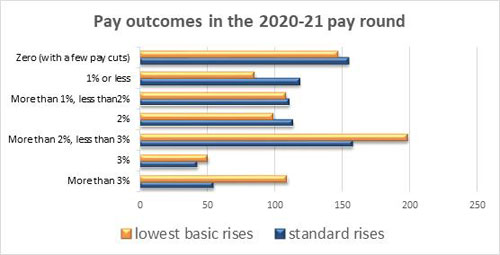

In the 2020-21 pay round the mid-point (median) increase on lowest basic rates was 2%, while the median for most workers was 1.8% (the “standard increase”).

But bargaining in the pandemic produced very varied results:

• settlements have been more subdued in the public sector than in the private sector, a fact that is reflected also in pay medians of 2% private sector as against 1.5% in the public sector;

• table 1 confirms that pay settlements in 2020-21 have generally been lower than in the previous two bargaining rounds, 2019-20 (with its mixture of pre-pandemic and post-lock down bargaining) and 2018-19 – a wholly pre-pandemic baseline when the median settlement level was 2.7%;

• table 1 also shows how volatile inflation and earnings growth have been compared with earlier pay rounds, with retail prices index (RPI) inflation as low as 0.5% and as high as 3.9%; and Average Weekly Earnings as low as 1% and as high as 5.9%; and

• table 3 shows notable pay increases in the private sector.

Table 1: Key figures from LRD Payline and the Office for National Statistics (August to July)

| Before the pandemic (2018-19) | Part-pandemic (2019-20) | Full pandemic (2020-21) | New pay round so far (2021-22)* | |

|---|---|---|---|---|

| Lowest basic increases (unweighted) | ||||

| Top 25% (upper quartile) | 3.20% | 3.04% | 2.70% | 3.87% |

| Middle of the range (median) | 2.70% | 2.55% | 2.00% | 2.95% |

| Bottom 25% (lower quartile) | 2.00% | 2.00% | 1.00% | 1.71% |

| Increase for most workers | ||||

| Top 25% (upper quartile) | 3.00% | 3.00% | 2.50% | 3.40% |

| Middle of the range (median) | 2.50% | 2.50% | 1.80% | 2.00% |

| Bottom 25% (lower quartile) | 2.00% | 2.00% | 1.00% | 1.20% |

| Number of deals | ||||

| Number of pay awards | 1,126 | 772 | 921 | 44 |

| Number of pay freezes (or cuts)* | 67 | around 40+ | around 150 | 3 |

| Annual RPI inflation | ||||

| Highest monthly level in the pay round | 3.50% | 2.70% | 3.90% | 4.9%* |

| Lowest monthly level in the pay round | 2.40% | 1.00% | 0.50% | 4.8%* |

| Average weekly earnings (regular pay) | ||||

| Highest monthly level in the pay round | 4.00% | 3.60% | 5.90% | 5.0%* |

| Lowest monthly level in the pay round | 3.10% | -0.20% | 1.00% | 5.0%* |

*Based on limited information

Before looking in more detail at what has happened in the private and public sectors, it is worth flagging up some general issues that have helped shape the pay round.

Labour shortages

Acute labour shortages have seen employers scrambling to up their pay offer. We’ve seen increases for HGV drivers ranging between 10% and 30+%, and the knock on effects are starting to be seen in other transport sectors, for example refuse workers and bus drivers; there are pay increases in response to shortages in food manufacturing; and “cracks” in the construction industry labour market.

• 2 Sisters Food Group (Sandycroft) agreed a deal to encourage recruitment and retention, and also to promote training and development into roles that are historically difficult to recruit into. It included a 6.38% increase for staff on the lowest pay grade to £9.50ph (40% of staff); a 10.76% increase for manual de bone (MDB) staff to £10.50ph (20% of staff); a 7.64% increase for ACM rehang to £10ph (10% of staff); a 6.7% increase for technical QA to £10.40ph; and a 4.7% increase for shift trainers to £10.20ph. All other grades increased by 31pph, equating to increases ranging from 2.4% to 3.4%.

• XPO Logistics (Arla Milk) Hatfield concluded a 15 month agreement from 1 April 2021 with an average increase of over 20% to basic rates of pay. The Sunday premium payment for unsocial hours increased by 31%. The class 1 driver hourly rate increased from £13.69 to £16.50, taking the guaranteed basic salary from £35,500 to £43,000, while the class 2 guaranteed basic salary increased from £32,600 to £40,000 (a 22.7% increase).

• Great Bear Distribution (Unilever contract) increased all elements of pay by 12.32%, but it also improved overtime rates from time and a third to time and a half, with double time for drivers undertaking additional shifts.

Minimum and Living wages

Expanding eligibility for the minimum wage is having an effect on negotiations. The age threshold for the NLW reduced from 25 to 23 this year and is set to fall to 21 in 2024.

Poundland removed its separate pay band for staff aged 21-24. For staff aged 21 and over, that gave an hourly rate of £9, an increase of 9.76% for staff aged 21-24 and 3.2% for staff of 25 and over. For staff aged 16-20, a new hourly rate of £6.65 represented a 3.1% increase. The pay differential for supervisors/PPCs also increased from 40pph to 50pph over the age 21+ rate, to £9.50ph, a 4.17% increase. Argos and Tesco have also moved in this direction.

There were big rises for those winning the voluntary living wage. For example, Ecocleen (Cleaners) at the La Retraite Catholic Girls School saw their pay go up by 24%, moving to the London living wage of £10.85ph from the previous National Living Wage at £8.72ph. In that case, wages withheld after a “Section 44 walkout” (due to members’ legitimate Covid-19 safety concerns) were repaid.

There were similar developments at grounds maintenance firm Idverde, Rail Gourmet (Eurostar contract) and Expert Logistics (Crewe), aiming to move up to the voluntary living wage by April 2022. School catering staff in Ealing, London, benefitted too, while IKEA was persuaded to re-commit to the voluntary living wage after union pressure.

Industrial action

There are no current statistics on levels of industrial action, as they were last published by the Office for National Statistics for January 2020. Groups of trade union members have seemed quite ready to take a stand on pay and conditions issues, despite being affected by the pandemic. Some of that action has been defensive, resisting “fire and re-hire” tactics by employers, but some of it has been more clearly aimed at winning improvements.

Refuse collectors in Bexley recently ended their long-running strike, having ratified a pay deal with Serco that included a one off £750 payment for 19 staff, and contract changes to reduce pay disparities (and other changes). But general union Unite also announced an agreement with Countrystyle Recycling, who took over the contract from Serco in October, that will see the lowest paid workers receive an 11% pay rise with rates increasing to £11.50 an hour, above the real London Living Wage of £10.85, as well as pay rises for staff on other grades.

Private sector

Our private sector results are based on 630 pay awards or deals, where we have known increases to lowest basic rates in 553 cases (covering approximately 2.1 million workers) and known standard increases in 514 cases.

The median increase on lowest basic rates was 2%, and the middle half of awards were worth between 1.4% and 2.7%. The median standard increase (for most workers in each agreement) was also 2%.

Basic rate awards are sometimes higher than the standard increase. But these private sector figures cover a wide range of individual settlements, with 13% of deals achieving over 3%, and, at the other end of the spectrum, 15% reporting a pay freeze. The vast majority of deals were between 1% and 3% and by far the largest proportion got between 2 and 3%.

Differences between the award for the lowest basic rate and the award for most workers (the standard increase) feature in 25 deals (5%, out of 495 where both figures are known). They almost invariably mean that the lowest grade got paid more. Some of the most notable private sector settlements (in addition to those already mentioned) are highlighted in the table on the previous page. But there has been a varied pattern within and between different industrial sectors.

Table 2: median 2020-21 pay rises (standard increase in brackets) compared with 2019-20

| Sector | 2020-21 | 2019-20 | ||

|---|---|---|---|---|

| Primarily private sector | ||||

| retail, wholesale, hotels and catering | 2.80% (2.20%) | 3.75% (2.80%) | ||

| manufacturing (other) | 2.20% (2.00%) | 2.60% (2.50%) | ||

| other services | 2.15% (2.00%) | 2.50% (2.35%) | ||

| manufacturing (engineering &metal products) | 2.10% (2.10%) | 2.40% (2.40%) | ||

| transport & communications | 2.00% (2.00%) | 2.68% (2.50%) | ||

| finance and business services | 2.00% (1.50%) | 2.50% (2.30%) | ||

| energy, water, mining & nuclear | 1.92% (1.84%) | 2.30% (2.30%) | ||

| construction | 1.25% (1.25%) | 2.75% (2.75%) | ||

| manufacturing (chemical, mineral & metals) | 1.70% (1.70%) | 2.30% (2.30%) | ||

| Primarily public sector | ||||

| public administration | 2.50% (2.00%) | 2.75% (2.63%) | ||

| health | 2.20% (3.00%) | 2.40% (2.00%) | ||

| education* | 1.00% (1.00%) | 2.75% (2.75%) | ||

* higher and further education are treated as public sector in the LRD pay survey

Manufacturing

The overall manufacturing median (2.0%) includes higher rises in food manufacturing but more mixed results in automotive, aerospace and materials. One fifth (20.4%) of settlements are over 3%, and three fifths are over 2%.

Examples of deals worth more than 2% included steelworkers at Tata Steel; aerospace workers at GE Aviation; and automotive workers at Leyland Trucks all achieving 3%. However, the pattern was not consistent, with the same sectors also including the 9.9% of manufacturing bargaining units that reported their pay was frozen for the year.

Transportation and storage

The median in transportation and storage (2.2%) reflected some of big rises in the logistics sector (see above). Over 10% of known settlements in transport were over 4%. This list is dominated by HGV drivers and there have been further substantial pay deals in this labour-shortage-stricken industry since the end of the pay round.

But others fared less well: the 15% of bargaining units that reported pay freezes for the year include aviation employers as well as some bus and rail drivers.

Wholesale and retail

The wholesale and retail sector, which includes companies that repair motor vehicles, had one of the strongest pay trends, with a 2.8% median on lowest basic rates. Morrison’s offered a £10 per hour base rate (the TUC and retail workers’ union USDAW’s objective for the statutory National Living Wage). Over a third of deals (37.5%) were above 3%.

The lowest paid Argos workers got 17%, as the retailer got rid of its youth rates and increased its base hourly rate to £9.50ph. Morrison’s workers got an 8.7% rise and an uplift to the basic rate of pay from £9.20ph to £10ph for both retail sales assistants and manufacturing.

Information and communication

This sector saw lowest basic rates rise by a median of 1.9%, led by industry agreements in TV and film production. Over half the settlements (52.4%) were worth over 2%. Advertising production (APA) crew rates, for example, went up by 6% (they hadn’t received a rise since 2018).

IT workers at IBM (Technology) and Capita in Communications and Digital (CMD) got 2.5%. However, nearly a quarter (26.4%) of agreements in this sector were pay freezes, including large television and broadcasting employers such as ITV and ITN, Al Jazeera (English) and Scottish TV and digital media publishing and services.

Financial and insurance activities

The finance sector saw rises of around 2%, but pay freezes were also common. However, the picture in the sector is harder to sum up, because deals are often either for fixed rate rises or pay bill rises of between 1.4 and 2.5%, with performance-related pay built in. Among those that negotiated increases to pay rates, just under 50% of deals were over 2%.

The Nationwide Building Society stands out with 5.26% for the lowest paid and 2% standard. However, while three quarters of these finance bargaining groups achieved pay rises, a significant group of mainly bank workers saw their pay frozen.

Administrative and support service activities

Deals in the sector had a median value of 2.2%, with outsourced workers achieving 2% and over, providing some important examples of union bargaining with big outsourcers including (CBRE) Airbus and Compass (Port Talbot) as well as in contracts with ISS, Compass, Engie, Suez, Sodexo and Capita. The vast majority (86%) of deals in this industry were on or over 2%. There was only one recorded pay freeze in this sector, in a call centre related to the aviation industry.

Construction

Pay rises were sluggish in the construction sector, producing a median increase of only 1.25% across the sector. While two thirds of deals showed a rise, there were more worth less than 2% than more. There were pay freezes in the national NAECI engineering construction industry agreement, in the Thermal Insulation Contracting Industry (TICI), and among electrical contractors. However, after a pay freeze in 2020, the biggest agreement (the Construction Industry Joint Council, CIJC) applied a 2.5% rise – not high enough to please the unions or some employers (see Workplace Report July 2021).

Arts, entertainment and recreation

Pay freezes in the sector helped to bring the median down to 1.7%, in a sector badly affected by the pandemic. However, by the close of the 2020-21 pay round, there were some brighter outcomes. Session musicians in advertising got a 3% pay rise on fees and allowances through a Musician’s Union agreement. There were rises of over 2% in the West Midlands for Birmingham repertory theatre staff, the Birmingham Royal Ballet, the Birmingham Symphony Orchestra and the Royal Shakespeare Company.

Energy and water

The energy sector, which in some years sees higher pay rises, produced a 1.82% median, with most bargaining groups getting rises of between 1% and 3%. Workers at Yorkshire Water Services (core) got 3%, while those at Western Power Distribution (WPD) got 2.55% in the second year of their deal. National Grid non-industrial staff and Severn Trent Water got 2.3% while clusters of employees reported deals in the 1-2% range, or freezes.

Table 3: Notable pay increases in the private sector

| Sector | % for lowest paid% | standard increase %% | key features |

|---|---|---|---|

| Administrative and support service activities | |||

| Ecocleen (Cleaners) La Retraite Catholic Girls School | 24.00% | 24.00% | move to London Living Wage |

| Idverde | 13.60% | move to London Living Wage | |

| WestRock Multi Packaging Solutions (Leicester) | 4.00% | flat rate £783 increase | |

| Arts, entertainment and recreation | |||

| Session Musicians (IPA/MU) | 3.00% | 3.00% | 3% all fees and allowances |

| Racing Staff NJC | 2.30% | rates above stautory minima | |

| Birmingham Repertory Theatre | 2.15% | 0.00% | uplift to Real Living Wage |

| Construction | |||

| Monumental Masonry | 14.50% | 14.5% Operatives, 15.8% Crafts | |

| Kaefer (Coulport, Faslane & Rosyth) | 3.00% | 3.00% | 3% on basic and overtime rates |

| Construction Industry Joint Council (CIJC) | 2.50% | 2.50% | 2.5% on all pay rates |

| Energy + Water | |||

| Yorkshire Water Services (core) | 3.00% | 3.00% | 3% on basic & associated rates |

| Western Power Distribution (WPD) | 2.55% | 2.55% | RPI underpinning rise |

| National Grid Non-industrial staff | 2.30% | 2.30% | across-the-board 2.3% |

| Financial and insurance activities | |||

| Nationwide Building Society | 5.26% | 2.00% | 2% or £470, whichever greater |

| Santander UK | 4.00% | guaranteed minimum £450 | |

| Information and communication | |||

| APA Crew Rates | 6.00% | 6.00% | 6% on previous 2018 rates |

| Lighting Technicians (Commercials) | 6.00% | 6.00% | Year 1 of 3-year agreement |

| Manufacturing | |||

| Bakkavor Meals London | 9.50% | 23pph for Production Operatives | |

| Forterra (Delivery Agents) | 9.43% | 9.43% | flat rate consolidated £3600 |

| 2 Sisters Food Group (Sandycroft) | 6.38% | increases to recruit, retain and train | |

| Transportation and storage | |||

| XPO Logistics (Arla Milk) Hatfield | 22.70% | average increase of over 20% | |

| Great Bear Distribution (Unilever contract) | 12.32% | 12.32% | 12.32% on all pay elements of pay |

| Stena Line Seafarers | 10.20% | 1.50% | included removal of lowest grade |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | |||

| Argos (Retail) | 17.00% | 5.60% | alignment with Sainsbury's |

| Boots (Pharmacists) | 13.30% | 0.00% | Northern Ireland rates aligned |

| Morrisons (retail and manufacturing) | 8.70% | 8.70% | uplift from £9.20ph to £10.00ph |

Public sector

The survey covers 291 public sector pay awards, with known increases to lowest basic rates in 243 cases and known standard increases in 234 cases. Pay freezes and pay increases of 1% or less were much more common in the public sector, where the median lowest-basic increase was 1.5% and the standard increase median was 1%. There were differences between the lowest basic and standard increases in 29 out of 200 public sector deals, deals where both figures are known (14.5%).

It is worth noting that 44 out of the 62 public sector pay freezes were individual further education colleges, an indication of the acute problems in that sector. The figures also include several bargaining units with inflation-linked increases of just 0.6%, negotiated within a single publicly-owned transport company (Caledonian MacBrayne ferries). While discounting those would lift the lowest-basic median to 2% it would still leave the standard median at a low point of 1%.

Pay freeze

The early months of the 2020-21 pay round (November 2020) saw the UK government announce a pay freeze in 2021-22 for civil servants and other public-sector workers whose pay it controls, including teachers and the police.

It made an exception for NHS workers, who would get 1%, and those earning less than £24,000pa would get at least £250. But the policy soon came unstuck. The UK government – under pressure to pay health workers more – accepted an NHS pay review body recommendation for 3% for staff in England covered by the Agenda for Change agreement. It was “not a pay offer”, according to public services union UNISON, but was implemented (its application in Wales and Northern Ireland is a separate process).

In Scotland, where the government has its own distinctive pay policy, equivalent NHS staff received an average 4% increase backdated to 1 December 2020. A flat rate increase of £1,009 for staff in bands 1-4 was worth 5.4% on the lowest basic rate (band 1); bands 5-7 got 4%, bands 8A-8C got 2%, and bands 8 D and 9 got £800. Neither deal was universally popular with the unions involved.

In the civil service, where bargaining is fragmented, staff at HMRC (Her Majesty’s Revenue and Customs) voted for a new three-year pay deal worth an average 13%. Despite the pay freeze policy, the Cabinet Office (at the heart of the UK civil service) has a two-stage two-year agreement allowing it to implement a pay award of 3% in each year.

In education, four teaching unions have joined forces to reject the public sector pay freeze and call for significant reform to the national pay structure in England, including the removal of performance-related pay (PRP). Most sections of the BBC workforce had their pay frozen in August 2020 but more recently there were rises of 1% for staff working for BBC Radio Drama and BBC TV scriptwriters.

Outside central government

The final outcome of bargaining between unions and local government employers for 2021-22 had not been settled as Workplace Report went to press. For England, Wales and Northern Ireland, the current offer is 2.75% to those on the lowest pay grade and 1.75% to everyone else. The pay review in Scotland was also uncompleted.

Pay is in dispute in the further and higher education sectors (see pages 3 and 5). Dozens of English colleges had a pay freeze, effectively ignoring the Association of Colleges’ recommendation of a rise of 1% or £250/1.62% increase on the lowest spine point. FE Scotland staff had a 2% rise. Under the FE Wales agreement there was an 8.48% increase to the minimum of the main grade (MG1) rate of pay, with all other MG rates increasing by 3.75%.

The September 2020 agreement for the JNC for youth and community workers deleted the two lowest pay points (3 and 4) and provided an increase of 2.75% on all others. For staff previously on pay point 3, this equates to a 6.57% increase. London area allowances and sleeping-in-duty allowance also increase by 2.75%.

Looking ahead

We are three months into the new pay round and, although next January and April will be the decisive months, it is already clear that some of the patterns we saw in 2020-21 are being repeated, although in the three months from August to September median levels are higher (around 3% on lowest basic rates, and a slightly lower standard increase median, based on around 50 deals):

• big pay rises in labour shortage industries, like the 31% pay rise at Wincanton’s Heywood depot (Argos), or the 11% for its mechanical offload drivers;

• incentives over and above basic pay: just as the earlier days of the pandemic saw some employers paying “thank you” bonuses separately from pay, labour shortages are now prompting similar responses. Warehousing company GIST in Chesterfield is an example, offering class 1 drivers sign-on bonuses of £2,000, retainer bonuses of £3,000, and matching “refer a friend” thank you payments;

• selective deals: a minimum 2.3% increase to basic pay for most depot grades at Hermes in the first year of a two-stage two-year agreement, but 1.5% on average for administration grades;

• implementation of delayed deals: last January’s delayed Thermal Insulation Contracting Industry increases of 2.5% on engineering rates and 2% on H&V rates have now been implemented with effect from 1 September (apprentice rates remained unchanged);

• higher-end pay rises: 3.9% at Electricity North West, in the first year of a three year extension to the previous three-year agreement based on the RPI for June 2021; 3% at Westex Carpets (Cleckheaton, West Yorkshire); and 2.7% at Tesco (retail) taking the basic rate of pay from £9.30ph to £9.55ph, and raising the night premium by 4% to £2.30ph;

• increases closer to 2020-21 pay round levels: BOC manual cylinder fillers getting 2.1%; Go South Coast (Swindon’s Bus Company) at 2%; and school academy chain Strictly Education (Surrey), also on 2%;

• lower public sector pay rises: 1.75% for school teachers in Wales; 1% for sixth form college teachers; and 1% for the Northern Ireland Civil Service;

• conditional deals: like the new three-year pay agreement at the Ministry of Justice, which will see staff wages rise initially by a minimum 4% and an average 9.9%, but with weekly working hours standardised at 37, and cuts in overtime payments in exchange; and

• pay freezes: for easyjet pilots, and staff at UK Export Finance (UKEF).

Skill shortages and other challenges

There seems to be little reason to think that skill shortages are going to go away. The Bank of England’s agents reporting on business conditions in the third quarter of the year found companies in a wide range of sectors reporting severe shortages of staff (Agents’ summary of business conditions - 2021 Q3).

Demand for staff was particularly strong in professional services, hospitality, logistics distribution and warehousing, construction and engineering. In hospitality, some contacts reported needing to recruit workers to replace furloughed staff who had switched jobs during closed periods.

This was leading to some upward pressure on pay, with awards now typically around 2%-3% (but much higher increases for skills in particularly short supply), leading employers also to step up apprenticeship programmes; hiring remote workers; increasing in-house training; investing in automation; streamlining product lines; increasing hours of existing staff or redeploying staff; and improving non-pay benefits and offering flexible working.

Other influences in the new pay round will include:

• National Insurance contribution increases of 1.25% are due from April 2022, eroding take-home pay levels;

• National Living Wage rises are also due in April although the new rates had not yet been announced as Workplace Report went to press;

• job insecurity is still an issue, not least with a large number of workers just coming off furlough whose outcomes are not yet known. While there are labour shortages on the roads there are job losses coming in the railway industry;

• Universal Credit cuts will hit lots of workers, adding to the pressure on living standards, but how likely is it that that will translate into higher settlements?

• policy differences between the UK government and the devolved governments could continue to affect relative pay levels: the Sottish government’s approach to public sector pay and its plans for national collective bargaining in the social care sector could have a growing impact;

• chancellor Rishi Sunak is predicted to be ready to end his pay freeze policy for parts of the public sector, but unless pay increases are funded, public sector workers may continue to struggle to keep up; and

• delayed pay settlements in the massive local government sector, when they are finally concluded, will potentially spill through into voluntary and arms-length employers close to the sector.

Inflation

Inflation is the wild card in this situation. Payline currently includes over 50 agreements with an explicit link to RPI inflation and over 20 with an explicit link to CPI. While these were affected by low inflation in 2020/21 (as some of the examples quoted above show), they will be affected by high inflation in 2021/22, assuming they are honoured.

However, most deals don’t have those inbuilt, explicit links to inflation and unions will have to persuade employers to fund appropriate pay rises. Inflation forecasts are notoriously unreliable but the average among independent forecasts for the rest of 2021 puts RPI at 4.6% and CPI at 3.2%. The same forecasters see inflation pressures easing by this time next year, to RPI 3.2% and CPI 2.2%. Bank of England projections in August saw CPI reaching 4%, before falling back to its 2% CPI target “in around two years’ time”.

Energy price rises and commodity shortages could mean high inflation for months to come. Unless that is factored in to more agreements, pay could be squeezed again. Last month Ian Wright, chief executive of the Food and Drink Federation, warned of inflation running at 14 to 18% in the hospitality sector.

In this turbulent environment, prime minister Boris Johnson has been talking up the need for a “high skill high wage economy”. It takes us back six years, when another Conservative prime minister, David Cameron, effectively endorsed the TUC slogan “Britain needs a pay rise”. By the end of the pay round, in July, RPI inflation had risen to 3.8%-3.9% and has now reached 4.9%, on the unions’ preferred RPI measure.

Reacting to the latest inflation figures, TUC general secretary Frances O’Grady said: “Inflation is still well above pay rises in the public sector and for those on the minimum wage. That puts the economy at risk from a fall in spending as families tighten their purse strings. It’s the last thing businesses need while they are trying to recover from the pandemic”. She called on the chancellor, Rishi Sunak, to fully fund a real pay rise for public sector workers, and boost the minimum wage to £10 per hour.

The LRD 20201 Pay Survey is available at www.lrd.org.uk/index.php?pagid=102

![[cover image]](images/issue/WR202111.jpg)

![[PDF]](images/pdf.gif)